Shipment of parcels abroad: how to limit the risk of block at customs? Part 2

Shipment of parcels abroad:

how to limit the risk of block at customs?

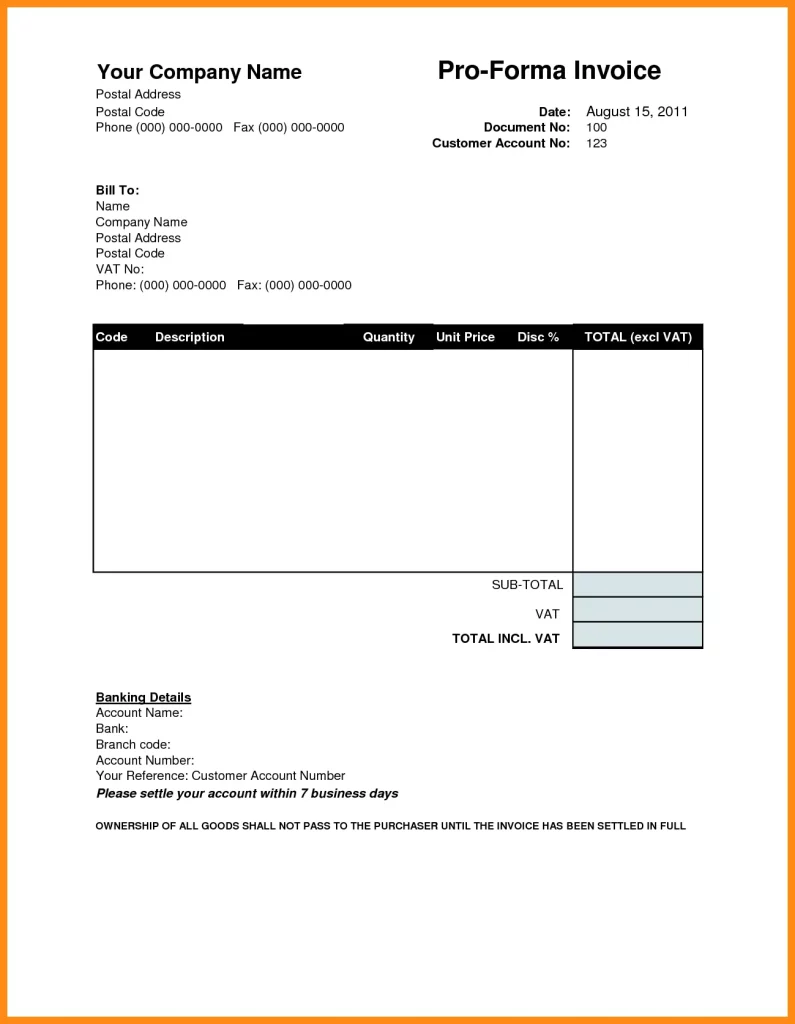

We are continuing our series on the way to avoid that your parcel gets blocked at customs. this step is very important because if the proforma invoice is incorrectly completed, then the risk of customs blocking and the request for additional information from customs is very high.

Fill out your commercial or proforma invoice very carefully

Customs will rely on this document to know what your parcel contains.

In most cases, the customs officers have the right to retain every parcel to check the goods or ask for further information.

Quick useful reminder, the commercial invoice is used in the case where you ship a good that you want to sell, whereas the proforma invoice is used to ship non-commercial goods, for example the reparation of an engine.

Example of a commercial invoice

A few precisions:

- “AWB” means “airway bill”. It is the number of your parcel’s “flight ticket”. This document is automatically filled out when you book on Expedismart. You will receive it per email at the end of your order

- Always fill out the information of the invoice in English.

- The EORI number (only if you ship to a firm): it is on the last line of the “recipient” part. It is an identification number given to every firm in the European Union. Before you book a shipment, we recommend that you get information from the destination firm so that it transfers you this number.

- VAT: VAT Number

- The incoterm “DAP”: this means that if there are customs fees in the destination country, they will be charged to the recipient. We recommend that you inform him about it. On Expedismart, all shipments take place in DAP.

- Be AS PRECISE AS POSSIBLE in the description of the product(s) contained in the parcel. Customs like transparency! If they notice that you are trying to be vague, they will be keen to check your goods.

- Avoid a too low value of the good. If you write “20 Swiss francs” for a computer, the customs officers will know that the information is wrong.